In today’s fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals in need of immediate cash. Thankfully, with the advent of technology, accessing instant loans has become easier than ever. If you’re in Nigeria and require 50000 instantly, various loan apps offer quick solutions. This comprehensive guide explores the top loan apps in Nigeria, ensuring you find the perfect match to address your financial needs promptly and efficiently.

Table of Contents:

| Heading |

|---|

| Finding Instant Financial Relief |

| Exploring the Best Loan Apps in Nigeria |

| Understanding the Application Process |

| Factors to Consider Before Applying |

| Ensuring Repayment Affordability |

| Comparing Interest Rates and Fees |

| Evaluating Customer Reviews |

| Ensuring Security and Privacy |

| Frequently Asked Questions (FAQs) |

| Conclusion |

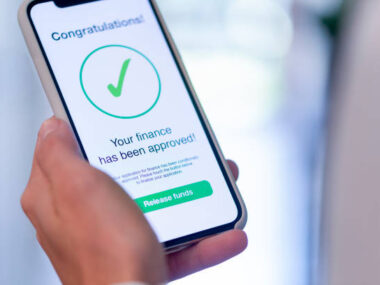

Finding Instant Financial Relief Are you facing a sudden financial crunch? Whether it’s for medical emergencies, unexpected bills, or any urgent expenses, having access to instant cash can be a lifesaver. In Nigeria, several loan apps cater to individuals needing quick financial assistance. Let’s delve into the details of these apps and how they can provide instant relief when you need it the most.

Exploring the Best Loan Apps in Nigeria When it comes to finding a loan app that offers 50000 instantly in Nigeria, you’re spoiled for choice. Several reputable apps provide quick access to funds with minimal hassle. Let’s explore some of the top contenders in the Nigerian market;

- Fairmoney

- RenMoney

- New credit

- Carbon loan

- KashKash

Understanding the Application Process Curious about how to apply for a loan using these apps? The application process is often straightforward and user-friendly, designed to ensure convenience for borrowers. Let’s walk through the typical steps involved in applying for a loan through these apps, making the entire process seamless and hassle-free.

Factors to Consider Before Applying Before diving into the world of instant loans, it’s essential to consider various factors to make an informed decision. From interest rates to repayment terms, evaluating these aspects can help you choose the right loan app that aligns with your financial needs and preferences.

Ensuring Repayment Affordability While instant loans offer immediate financial relief, it’s crucial to assess your repayment capacity to avoid falling into a debt trap. Understanding the repayment terms and ensuring affordability is key to managing your finances responsibly.

Comparing Interest Rates and Fees Interest rates and fees vary among different loan apps, impacting the overall cost of borrowing. By comparing these aspects across various apps, you can identify the most cost-effective option that minimizes your financial burden.

Evaluating Customer Reviews Customer reviews provide valuable insights into the reliability and efficiency of loan apps. By reading real-life experiences shared by other users, you can gauge the app’s credibility and customer satisfaction levels.

Ensuring Security and Privacy When dealing with financial transactions, security and privacy are paramount. Opting for loan apps with robust security measures ensures that your personal and financial information remains safe and protected from unauthorized access.

Conclusion In conclusion, finding a loan app that offers 50000 instantly in Nigeria is easier than ever, thanks to the multitude of options available. By considering factors such as interest rates, fees, customer reviews, and security measures, you can make an informed decision and choose the app that best meets your financial needs. So, whether you’re facing an unexpected expense or need funds for personal reasons, these loan apps provide a convenient and reliable solution to tide you over during challenging times.